Base by Base Biweekly: May 11, 2025

Vinay Prasad named to FDA leadership; Novo teams up with CVS; CGMs move towards mass adoption; Natera's margin question. And, biweekly market updates.

First, perspectives on notable healthcare and life sciences news stories. Then, the usual biweekly market, multiples, and stock performance updates.

News Roundup

Vinay Prasad named director of FDA’s Center for Biologics Evaluation and Research

Prasad will helm the FDA division responsible for approving vaccines and cell & gene therapies. Biotech stocks sold off immediately and sharply on the news (XBI -9% last week)1.

Prasad has a history of skepticism about whether new drugs provide as much benefit as advertised (especially new oncology agents), and has called for clinical trials with more stringent endpoints (e.g., overall survival rather than progression-free survival).

This is out of step with the FDA’s direction of travel over the last 10 years, which has been to allow surrogate endpoints in order to get drugs approved faster.

Several years ago, I found Prasad to be provocative but deeply thoughtful, substantive, and statistically rigorous. His YouTube videos on Kaplan-Meier curve interpretation are fantastic, as was his Plenary Session podcast. I’ve been less compelled by his (relatively insufferable) X poaster persona of the last few years2.

On the positive side, Marty Makary, the FDA commissioner, seems quite pro-innovation. His biggest announcements thus far have centered around getting drugs to market faster (e.g., reduced preclinical animal testing), and cutting red tape.

Could there be a golden path? Let’s assume that Makary does want a more Thiel-ian FDA: one that moves faster and is more permissive after drugs prove safety and early signs of efficacy. In this case, you need a credible “bad cop” to make sure it doesn’t turn into a gravy train for biopharma. Perhaps Prasad is just such a bad cop - keeping companies honest with trial design, and cracking the whip on post-marketing commitments.

Novo teams up with CVS to gain preferred formulary position for Wegovy

CVS Caremark struck a deal with Novo Nordisk to give Wegovy the primary obesity spot on its main commercial formulary template, excluding Eli Lilly’s Zepbound.

This is a badly-needed win for Novo. Up until now, Zepbound has been pummeling Wegovy in new patient market share, given its higher efficacy.

But this is also the surprising part of the announcement. Zepbound is better than Wegovy at generating weight loss (20% vs. 14% body weight loss head-to-head in SURMOUNT-5). If I were a CVS Caremark member and I had to take Wegovy instead, I’d be pretty unhappy.

Is this the start of a GLP-1 price war, where PBMs play Lilly and Novo off each other to obtain the best price? I’d bet on a continued rational duopoly. While Novo may make moves to prevent Lilly from taking the US market wholesale, Zepbound should be able to maintain both a pricing advantage and a new patient market share advantage, due to its efficacy.

The other factor to consider is geopolitics. In the America First era, is there any chance that a Danish company plays hardball with a US company in the US market? I don’t see it. Indeed, Novo has been treated much more roughly by Congress than Lilly. If I were Lilly leadership, I would make absolutely sure that Trump administration knows that CVS Caremark plans to funnel billions to Denmark when they could have kept it in the US.

Continuous glucose monitors (CGMs) move towards mass adoption

CGMs initially gained adoption among Type I diabetics, who required frequent glucose monitoring to dose their insulin. Then, they expanded into severe Type II diabetics who similarly required multiple daily insulin injections.

Now, CGMs are gaining traction in people who don’t need insulin at all. Health insurers increasingly cover CGMs for any Type II diabetics, including those who don’t require insulin.

And more disruptively, since late 2024, CGMs are available direct-to-consumer. Dexcom’s “Stelo” and Abbott’s “Lingo” can be purchased online, without a prescription.

At Dexcom’s earnings last week, they observed more customers starts from non-insulin users than any time in their history.

I’ll be interested in how “mass market” CGMs become. I use Stelo relatively often, and it’s just fun enough for me to think that widespread CGM use will be a thing, but also just useless enough for me to think it won’t be that much of a thing.

The economics of this market are also going to be very different for both Dexcom and Abbott. When CGMs were geared towards Type I and severe Type II diabetics, sales reps primarily had to detail endocrinologists. Given the small prescriber base (5-10K US endocrinologists) and high patient retention, unit economics were excellent.

But adoption among the broader population is a very different go-to-market: mass PCP canvassing (which, as we discussed last week, is very expensive, given the 250-500k PCPs in the US), DTC advertising, and less retentive/less committed patients. My base expectation is that while the TAM is huge, the unit economics will be more challenging.

This makes Dexcom one of the most interesting companies in healthcare from a stock-picking perspective. On one shoulder, an angel whispers that there are 100M Americans with pre-diabetes, and if Abbott and Dexcom each get only 5M of these (10% total penetration between the two), and patients only use them for 6 months per year, that’s $3B incremental revenue (5M * 6 months * $100 per month), which would almost double Dexcom’s current revenue base.

On the other shoulder, a devil whispers that the $3B incremental revenue will come at lower margins than the business has historically generated, and continued GLP-1 uptake will eat away at the core business by decreasing Type II diabetes incidence and frequency of insulin use among diabetics.

Natera crushes revenue estimates, but profitability comes into focus

Natera handily beat Q1 revenue expectations (+13% vs. consensus), driven by continued strength from Signatera in MRD.

Despite the beat and raise, the stock fell 7% the day after earnings.

In addition to raising the full-year revenue guide by 3%, Natera raised their planned SG&A spend by 5%. This was likely a major contributor to the stock decline: the market wants to see more margin leverage.

Natera’s competitive position in MRD is as good as it gets - they have a vice grip on the market, with 90%+ share.

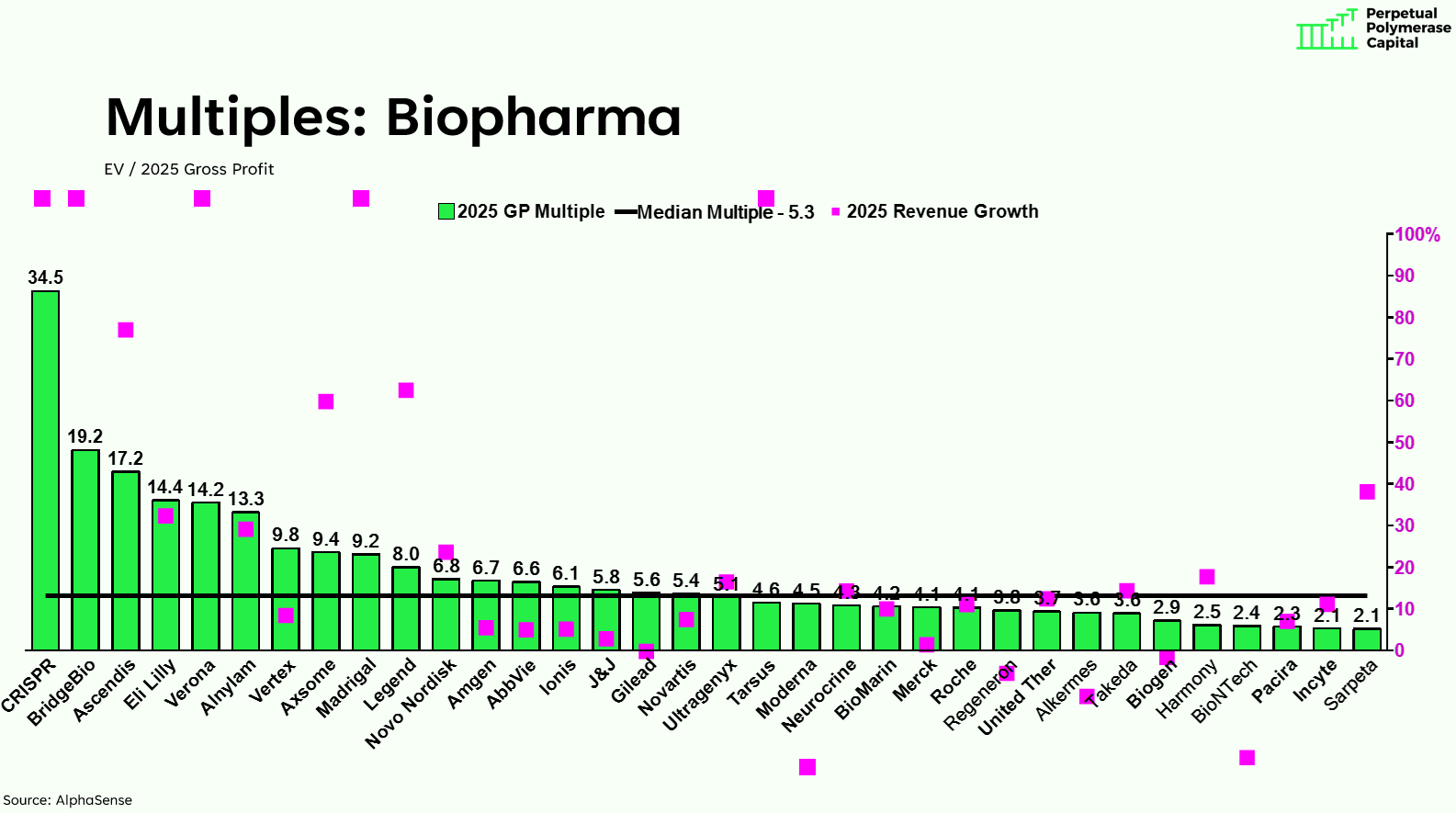

But my sense is that this alone isn’t going to be enough for the stock going forward. At 17x gross profit, for the model to work, you need to believe that Natera can get meaningful operating leverage over the next several years, and ultimately mature into a 20%+ EBIT company. As discussed in a previous post, I think they can. But, napkin math and actually doing it are two very different things.

High-multiple stocks with immature margins (like Natera) are a high-wire act. While growth is beating expectations, things usually work well. But if the markets ever find a reason to doubt growth, things can get ugly. In my experience, markets will always find just such a reason, even if it’s just a quarterly hiccup. If the narrative on Signatera shifts from “obvious secular winner in a $5B+ TAM” to “where is incremental penetration going to come from now that they’ve won colorectal and breast?” it could be a tough run for the stock, unless they demonstrate more margin leverage on the way there.

Market Updates

Index Performance

Both healthcare and broad indices bounced back over the last 30 days, as “liberation day” morphed into what appears to be “let’s make a deal summer”. Biotech is the area that continues to feel the deepest pain, with XBI down 15% on the year thus far.

Chart: Index performance

Multiples

Across all 121 companies in our coverage universe, median 2025 gross profit multiple is 6.7x, essentially flat from 2 weeks ago (6.6x), and down 8% from mid-February, when markets peaked (7.3x)3.

Chart: Gross profit multiple and 2025 revenue growth, all companies

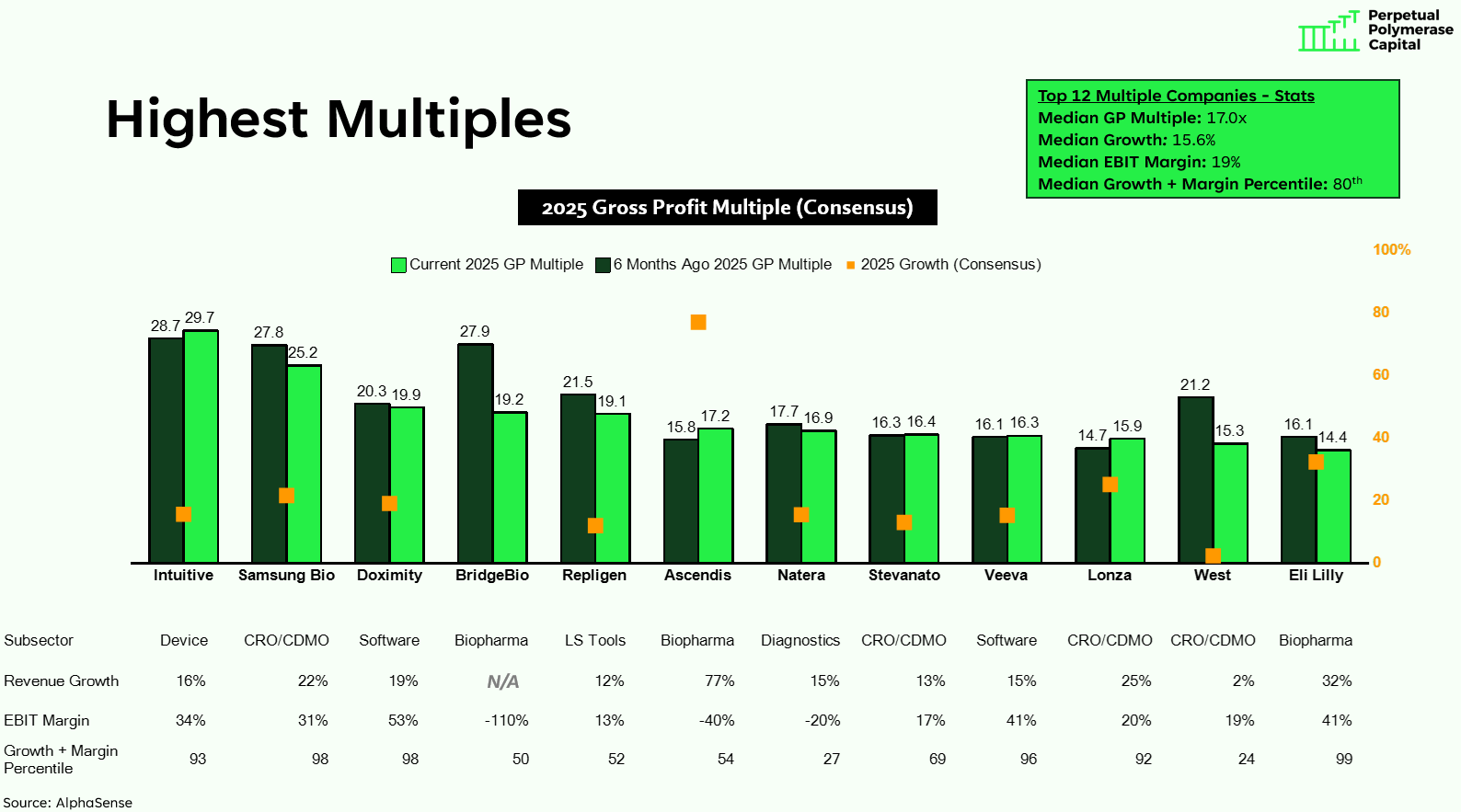

Median multiple among the 12 highest multiple companies is 17.0x 2025 gross profit, down from 18.4x two weeks ago, and 22.0x in mid-February. As discussed last week, this set of companies is significantly higher growth than median (15.6%, vs. 9.6% median) and higher margin (19% EBIT, vs. 16.4% median). As a result, the median top 12 company is in the 80th percentile of “growth + margin” score.

Chart: 12 highest multiple companies4

Median multiple among the 12 lowest multiple companies is 2.1x 2025 gross profit, down from 2.2x two weeks ago, and 2.7x in mid-February. This set of companies is significantly lower growth than median (0.7%, vs. 9.6% median) and lower margin (3% EBIT, vs. 16.4% median). As a result, the median bottom 12 company is in the 19th percentile of “growth + margin” score.

Chart: 12 lowest multiple companies

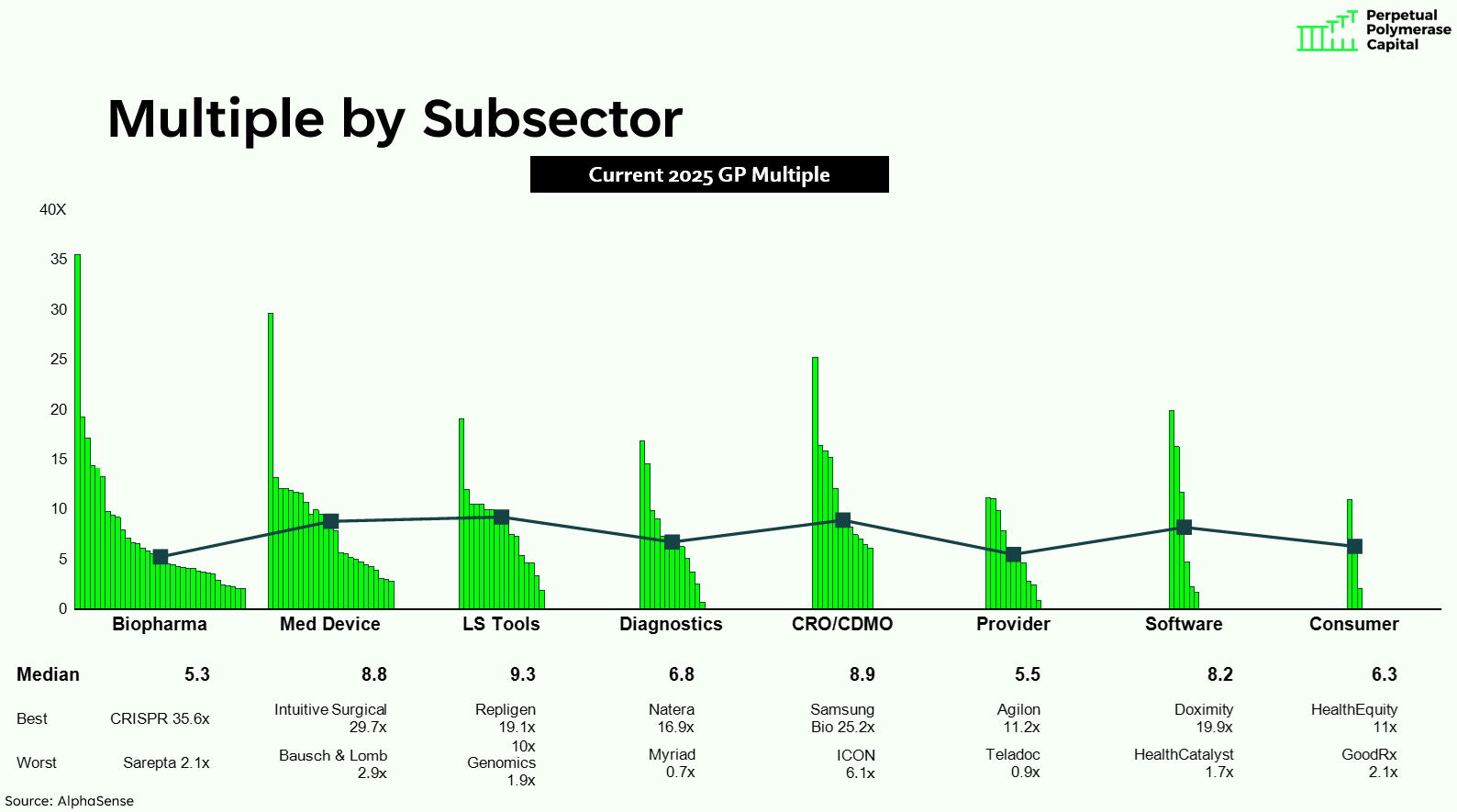

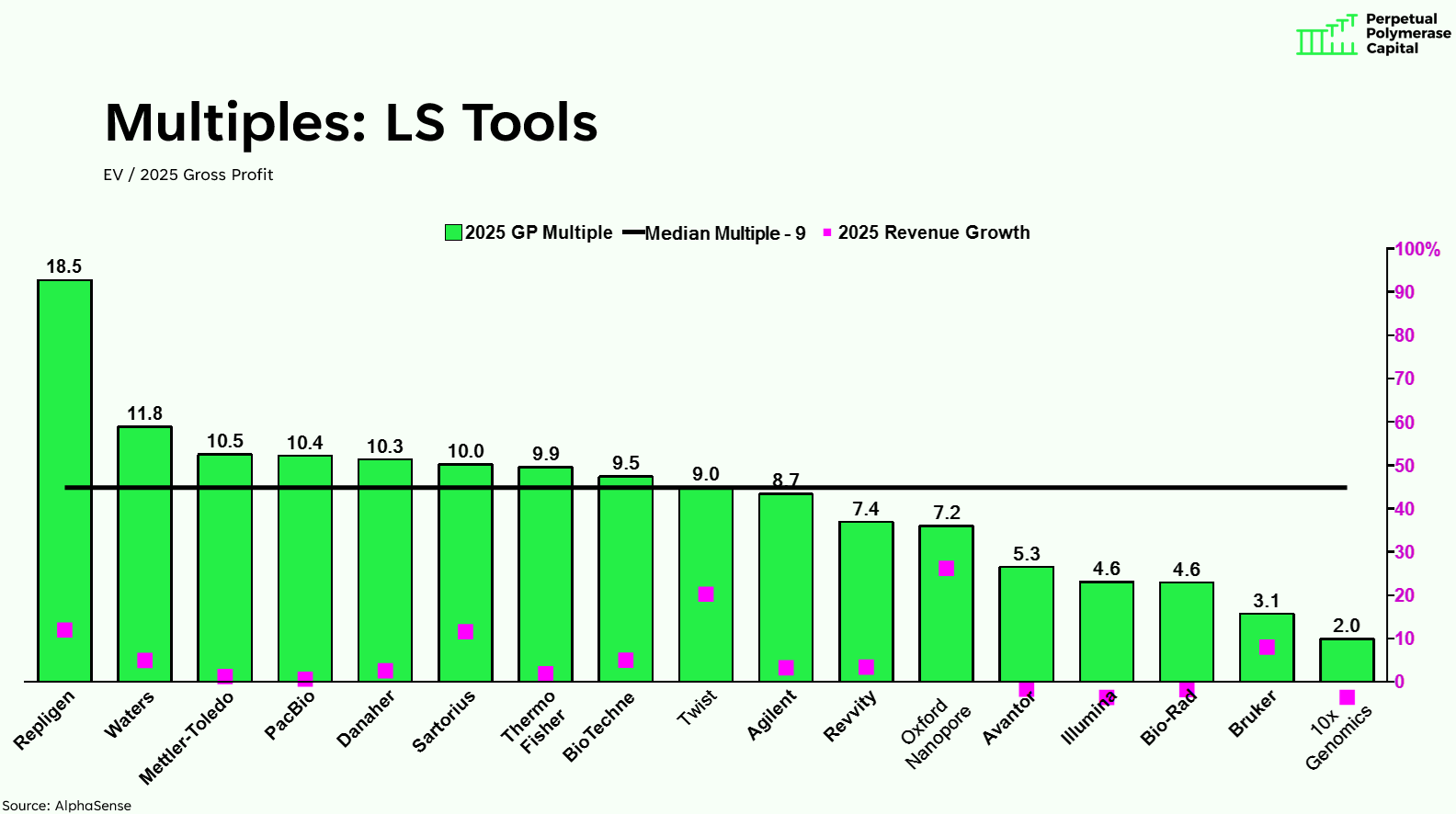

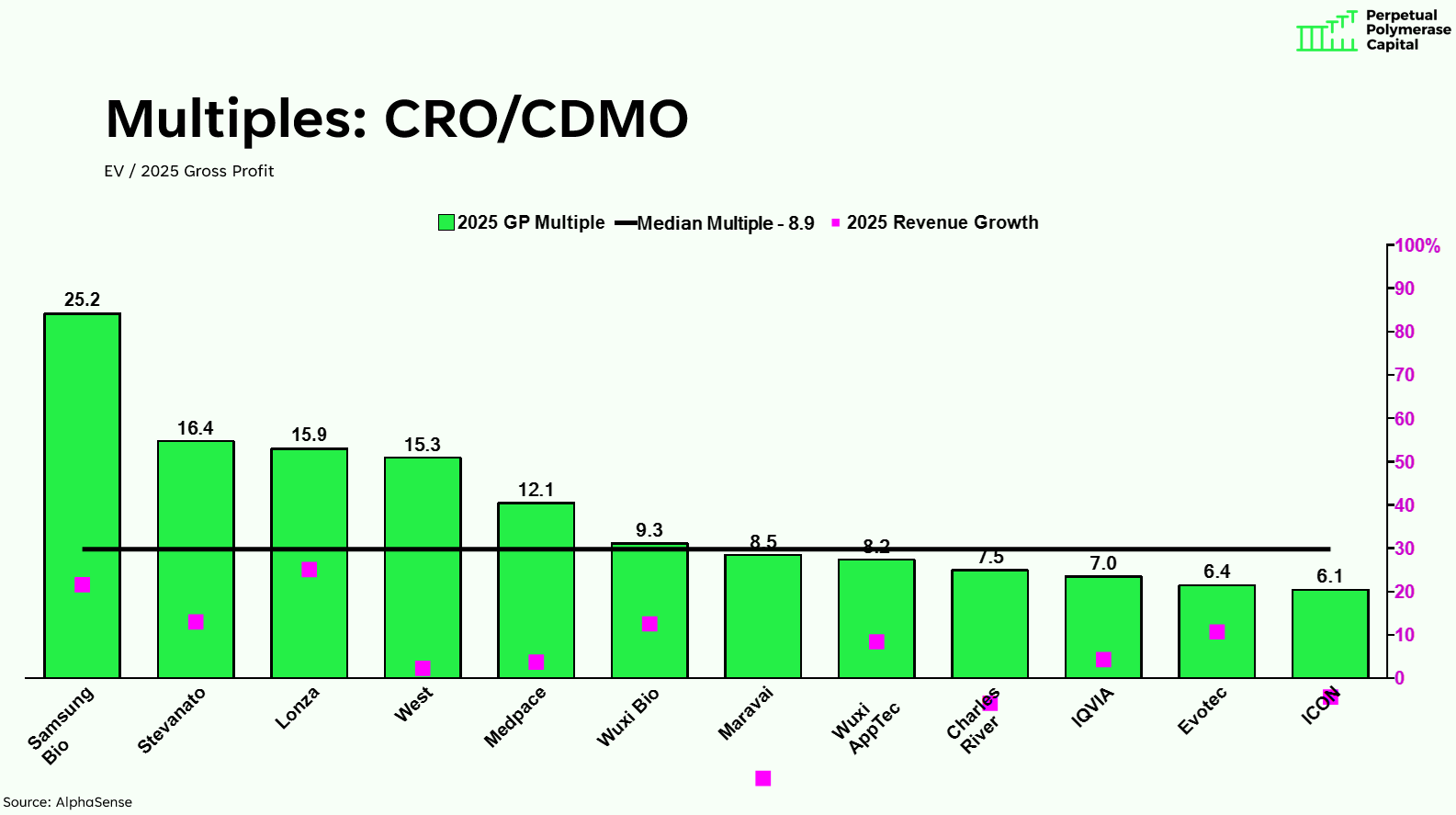

Subsector Multiples & Stock Changes

The below charts show multiples and stock price performance (last 6 months) across subsectors - e.g., diagnostics vs. devices vs. tools, etc.

Diagnostics is the only subsector that doesn’t have negative median stock performance over the last 6 months. This makes sense: diagnostics companies have minimal exposure to tariffs (they run US labs for US customers, and likely have longer-term agreements with key suppliers like Illumina), and frankly, they aren’t sexy enough to ever be caught up in the political maelstroms of the biopharma sector.

Chart: Range of stock price changes over last 6 months

Chart: Range of GP multiples (high to low) for companies within each healthcare subsector

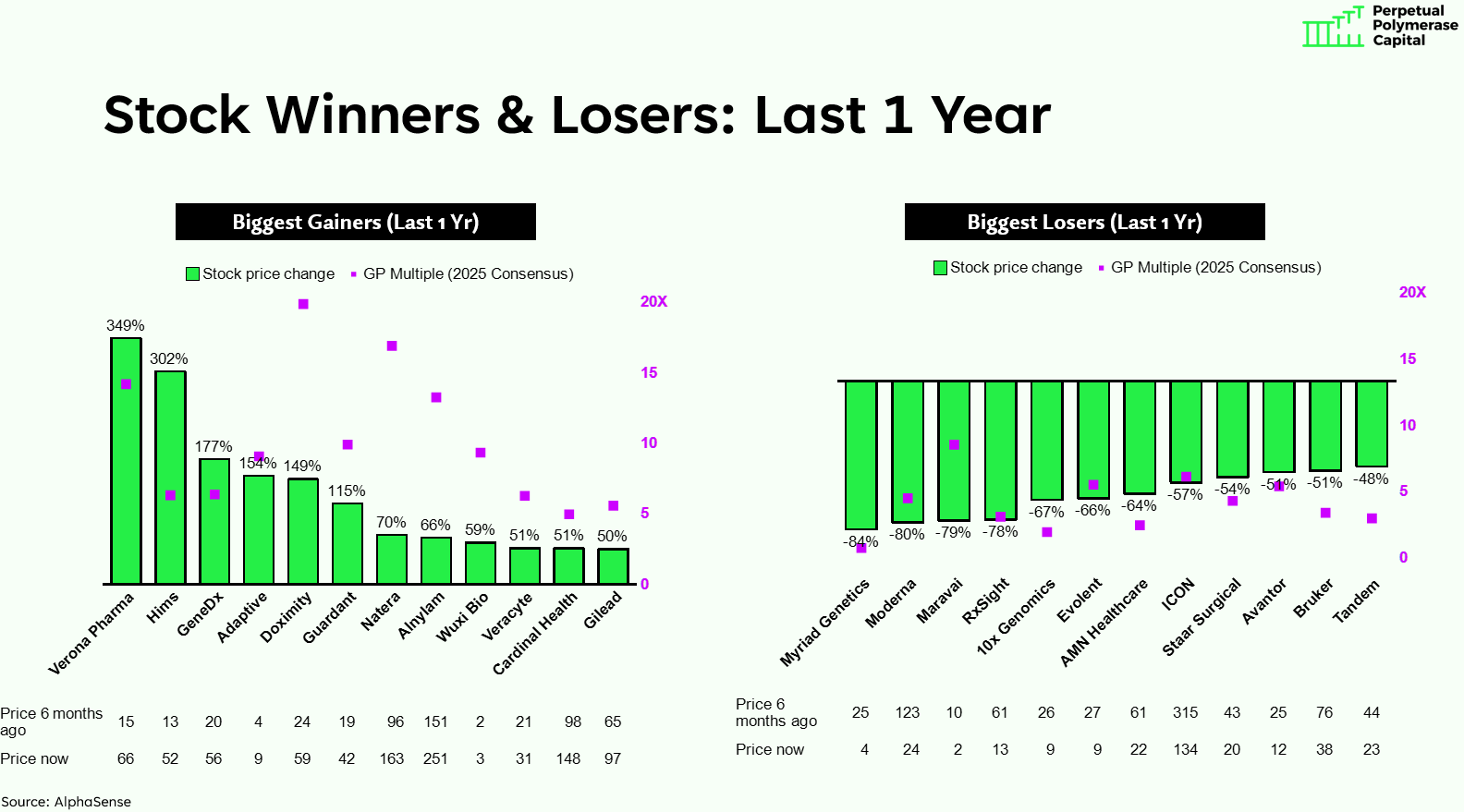

Stock Winners & Losers

Chart: 12 best and worst performing stocks over last 6 months

Chart: 12 best and worst performing stocks over last 1 year

Stock Price Performance, All Companies YTD

Chart: Stock price performance YTD (all companies)

Largest Consensus Estimate Changes

Chart: Largest positive and negative consensus estimate changes year-to-date

There are also rumors that the Trump administration is planning to propose a “most favored nation” (MFN) mandate for drugs, meaning that the US can’t pay more for drugs than other developed countries. If this happens, look out: pharma and biotech have another big leg down.

There seems to be an unfortunate law of physics that when people with interesting things to say about a niche subsector get a microphone and a podcast, within a year, they will be talking exclusively about politics and DEI.

For this same set of 121 companies.

I exclude CRISPR Therapeutics here, given low absolute gross profit dollars